2001 Theurer Boulevard

Winona, Minnesota 55987-0978

(507) 454-5374

Dear Fellow Shareholders:

I am pleased to invite you to attend our annual meeting to be held at Fastenal's home officethe Remlinger Muscle Car Museum located at 2001 Theurer Boulevard,3560 Service Drive, Winona, Minnesota, 55987, commencing at 10:00 a.m., central time, on Tuesday,Thursday, April 24, 2018.25, 2024.

The following notice of annual meeting and the proxy statement describe the matters to come before the annual meeting. During the annual meeting, we will also review the activities of the past year and items of general interest about Fastenal and will be pleased to answer your questions. Please join us for lunch immediately following the annual meeting. For those interested in our history, the Fastenal Museum is located at 69 Lafayette Street, Winona, Minnesota. This is the location of our first branch, and will be open to the public from 12:00 p.m. to 5:00 p.m. on the day of the meeting.

This year we are again taking advantage of a Securities and Exchange Commission (SEC) rule allowing us to furnish our proxy materials over the internet. If you are a shareholder who holds shares in an account with a broker (also referred to as shares held in 'street name'), you will receive a notice regarding availability of proxy materials by mail from your broker. The notice will tell you how you can access our proxy materials and provide voting instructions to your broker over the internet. It will also tell you how to request a paper or e-mail copy of our proxy materials. If you are a shareholder whose shares are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC (a 'registered shareholder'), you will continue to receive a copy of our proxy materials by mail as in previous years.

We hope that you will be able to attend the annual meeting in person and we look forward to seeing you.person. Whether or not you plan to attend the meeting, your vote is important and we encourage you to vote by completing and returning the enclosed proxy promptly.

| Sincerely, | |||||

| |||||

| Scott A. Satterlee | |||||

| Chair of the Board | |||||

FASTENAL COMPANY

Notice of Annual Meeting of Shareholders

| DATE & TIME | ||||||||

| PLACE | Remlinger Muscle Car Museum 3560 Service Drive Winona, Minnesota 55987 | |||||||

ITEMS OF BUSINESS | 1. The election of a board of directors consisting of | |||||||

| meeting of shareholders | ||||||||

| 2. The ratification of the appointment of KPMG LLP as our independent registered public | ||||||||

| accounting firm for the year ending December 31, | ||||||||

| 3. An advisory vote on a non-binding resolution to approve the compensation of certain of our | ||||||||

| executive officers disclosed in this proxy statement. | ||||||||

| 4. | ||||||||

| regarding supermajority approval of | ||||||||

| 5. The consideration of a shareholder proposal contained in the proxy statement relating to simple | ||||||||

| majority vote, if properly presented at the annual meeting. | ||||||||

| 6. The transaction of such other business as may properly be brought before the annual meeting. | ||||||||

| RECORD DATE | You may vote at the annual meeting if you were a shareholder of record at the close of business on February | |||||||

| VOTING BY PROXY | YOUR VOTE IS IMPORTANT – Your proxy is important to ensure a quorum at the annual meeting. Even if you own only a few shares, and whether or not you plan to attend the meeting, please follow the instructions you received to vote your shares as soon as possible to ensure that your shares are represented at the meeting. | |||||||

| Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on April 25, 2024: The notice, proxy statement, and 2023 annual report are available at www.proxyvote.com. | ||||||||

| By Order of the Board of Directors, | |||||

| |||||

| John J. Milek | |||||

| Vice President General Counsel | |||||

Winona, Minnesota

PROXY STATEMENT

Proxies are being solicited by the board of directors of Fastenal Company (hereinafter referred to as Fastenal or by terms such as the company, we, our, or us) for use in connection with the annual meeting to be held on Tuesday,Thursday, April 24, 201825, 2024 at our principal executive office3560 Service Drive, Winona, Minnesota, 55987, commencing at 10:00 a.m., central time, and at any adjournments thereof. The mailing address of our principal executive office is 2001 Theurer Boulevard, Winona, Minnesota 55987-0978 and our telephone number is (507) 454-5374. The mailing of this proxy statement and our board of directors' form of proxy to shareholders whose shares are registered directly in their names with our transfer agent ('registered shareholders') will commence on or about March 13, 2018.15, 2024. The mailing of the notice regarding availability of proxy materials to our shareholders who hold shares in accounts with brokers (also referred to as shares held in 'street name') will commence on or about the same date.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking information within the meaning of the Private Securities Litigation Reform Act of 1995 that is subject to certain risks and uncertainties that could cause actual results to differ materially from those projected, expressed, or implied by such forward-looking information. Risks and uncertainties that could cause or contribute to such differences include, but are not limited to, those discussed in Item 1A, "Risk Factors" included in our Annual Report on Form 10-K, as may be updated in our subsequent Quarterly Reports on Form 10-Q. To the extent permitted under applicable law, we assume no obligation to update any forward-looking statements as a result of new information or future events

-1-

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

What am I voting on?

These are the proposals scheduled to be voted on at the annual meeting:

•Election of all teneleven directors ('Proposal #1');

•Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 20182024 ('Proposal #2');

•Adoption of a resolution approving, on an advisory, non-binding basis, the compensation of certain of our executive officers ('Proposal #3'); and

•Approval of the Fastenal Company Non-Employee Director Stock Option Planan amendment to our Restated Articles of Incorporation to delete Article VI regarding supermajority approval of business combinations with certain interested parties ('Proposal #4'); and

•Consideration of a shareholder proposal relating to simple majority vote ('Proposal #5').

Who is entitled to vote?

The common stock of Fastenal, par value $.01 per share, is our only authorized and issued voting security. At the close of business on February 23, 2018,26, 2024, there were 287,647,564572,426,650 shares of common stock issued and outstanding, each of which is entitled to one vote. Only shareholders of record at the close of business on February 23, 201826, 2024 will be entitled to vote at the annual meeting or any adjournments thereof.

What constitutes a quorum?

The presence at the annual meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding at the close of business on the record date will constitute a quorum for the transaction of business at the meeting.

How many votes are required to approve each proposal?

Election of Directors

As is the case this year, where the number of nominees does not exceed the number of directors to be elected, directors are elected under a majority voting standard. This means that each director must receive more votes for his or her election than votes against in order to be elected. If an incumbent director fails to receive a sufficient number of votes to be elected, he or she must promptly offer to resign, and the nominating and corporate governance committee will make a recommendation on the resignation offer and the board must accept or reject the offer within 90 days and publicly disclose its decision and rationale. Shareholders do not have the right to cumulate their votes in the election of directors.

Ratification of Independent Registered Public Accounting Firm

The affirmative vote of the holders of the greater of (1) a majority of the shares of common stock present in person or by proxy at the annual meeting and entitled to vote or (2) a majority of the minimum number of shares entitled to vote that would constitute a quorum for the transaction of business at the annual meeting is required for approval of Proposal #2.

Approval of Executive Compensation

The vote to approve our executive compensation is advisory and not binding on our board of directors. However, our board will consider our shareholders to have approved our executive compensation if the number of votes 'FOR' Proposal #3 exceeds the number of votes 'AGAINST' Proposal #3.

Approval of an Amendment to our Restated Articles of Incorporation

The affirmative vote of the Fastenal Company Non-Employee Director Stock Option Planholders of not less that seventy-five percent (75%) of all outstanding shares of common stock present in person or by proxy at the annual meeting and entitled to vote generally in the election of directors is required for approval of Proposal #4.

Shareholder Proposal

The affirmative vote of the holders of the greater of (1) a majority of the shares of common stock present in person or by proxy at the annual meeting and entitled to vote or (2) a majority of the minimum number of shares entitled to vote that would constitute a quorum for the transaction of business at the annual meeting is required for the approval of Proposal #4.#5.

-2-

How are votes counted?

You may vote 'FOR', 'AGAINST' or 'ABSTAIN' on Proposals #1, #2, #3, and #4.each proposal. Abstentions will be counted as present for purposes of determining the existence of a quorum. If you abstain from voting on either Proposal #2any proposal other than the election of directors or Proposal #4,the approval of executive compensation, it has the same effect as a vote against the proposal. An abstention will not have any effect on the outcome of the voteelection of directors or on Proposal #1, or #3.the approval of executive compensation. If you just sign and submit a proxy card without voting instructions, your shares will be voted 'FOR' each director nominee, and 'FOR' or 'AGAINST' any other proposal as recommended by the board.

What is a broker non-vote?

If shareholders do not give their brokers instructions as to how to vote shares held in street name, the brokers have discretionary authority to vote those shares on 'routine' matters, such as the ratification of independent registered public accounting firms,Proposal #2, but not on 'non-routine' proposals, such as the other proposals scheduled to be voted on at the annual meeting.Proposals #1, #3, #4, and #5. As a result, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. This is sometimes called a 'broker non-vote'. Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers will be counted as present for the purpose of determining whether there is

a quorum at the annual meeting, but will not be counted or deemed to be present in person or by proxy and entitled to vote for the purpose of determining whether our shareholders have approved that matter.

How does the board recommend that I vote?

Fastenal's board recommends that you vote your shares:

•'FOR' each of the nominees to the board named in this proxy statement;

•'FOR' the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2018;2024;

•'FOR' the adoption of a resolution approving, on an advisory, non-binding basis, the compensation of certain of our executive officers; and

•'FOR' the approval of an amendment to our Restated Articles of Incorporation to delete Article VI regarding supermajority approval of business combinations with certain interested parties; and

•'AGAINST' the Fastenal Company Non-Employee Director Stock Option Plan.adoption of the shareholder proposal, if properly presented at the meeting.

How do I vote my shares without attending the annual meeting?

Registered Shareholders

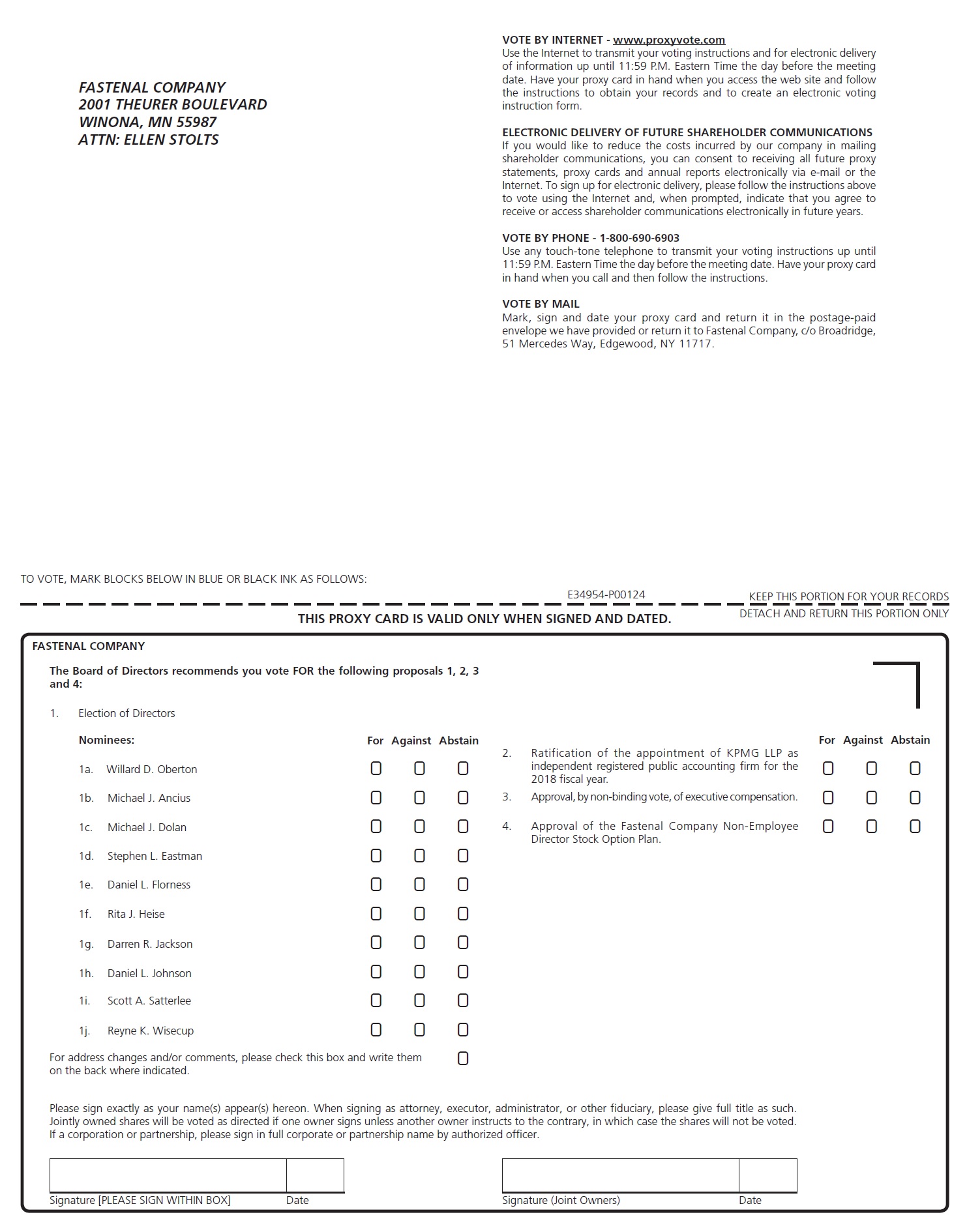

If you are a registered shareholder, you may vote without attending the annual meeting by telephone, over the internet, or by mail as described below. To vote:

•By telephone,telephone: (1) on a touch-tone telephone call toll-free 1-800-690-6903, 24 hours a day, seven days a week, until 11:59 p.m., eastern time, on April 23, 2018,24, 2024, (2) have your proxy card available, and (3) follow the instructions provided;

•Over the internetinternet: (1) go to www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m., eastern time, on April 23, 2018,24, 2024, (2) have your proxy card available, and (3) follow the instructions provided; or

•By mailmail: (1) mark, date, and sign the enclosed proxy card, and (2) return the proxy card in the enclosed postage-paid envelope to Fastenal Company,Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. You should sign your name exactly as it appears on the proxy card. If you are signing the proxy card in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity.

Shares held jointly by two or more registered shareholders may be voted by any joint owner, unless we receive written notice from another joint owner denying the authority of the first joint owner to vote those shares.

Shares Held in Street Name

If you hold your shares in street name, you will receive a notice regarding availability of proxy materials that will tell you how to access our proxy materials and provide voting instructions to your broker over the internet. It will also tell you how to request a paper or e-mail copy of our proxy materials. As noted above, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposals on which your broker does not have discretionary authority to vote.

-3-

Shares Held in the Fastenal Company and Subsidiaries 401(k) and Employee Stock Ownership Plan ('401(k) plan')

If you participate in our 401(k) plan and have investments in the Fastenal stock fund, you will receive instructions from the trustee of the plan that you must follow in order for shares attributable to your account to be voted. The trustee will vote shares for which no directions have been timely received, and shares not credited to any participant's account, in proportion to votes cast by participants who have timely responded.

How do I vote my shares in person at the annual meeting?

If you are a registered shareholder and prefer to vote your shares at the annual meeting, bring the enclosed proxy card or proof of identification. You may vote shares held in street name only if you obtain and bring to the annual meeting a signed proxy from the record holder (broker or other nominee) giving you the right to vote the shares. Shares attributable to your account in our 401(k) plan may not be voted by you in person at the annual meeting. Even ifmeeting and you planmust follow the instructions provided by your broker for any shares held in street name to attendbe able to participate and vote at the annual meeting, wemeeting. We encourage you to vote in advance by telephone, over the internet, or by mail so that your vote will be counted if you later decide not to attend the meeting. If you are a registered shareholder who wishes to vote in person at the annual meeting and have previously submitted a proxy, you must deliver to an officer of Fastenal a written notice of termination of the proxy's authority before the vote. Attendance at the annual meeting will not itself revoke a previously granted proxy.

How do I change my vote?

If you are a registered shareholder, you may revoke your proxy (1) prior to the annual meeting by mailing a later dated proxy or by submitting a subsequent proxy by telephone or over the internet at any time before the applicable deadline noted above, or (2)above. Attendance at the annual meeting itself will not revoke a previously granted proxy unless written notice of the revocation or subsequent proxy is revoked as described in the previous sentence or, by delivering to an officer of Fastenal a written notice of termination of the proxy's authority at any

time prior to the vote.meeting. If you hold your shares in street name or through our 401(k) plan and wish to change your vote, you should follow the instructions received from your broker or the trustee of the plan.

* * * * * * * * * *

-4-

PROPOSAL #1—ELECTION OF DIRECTORS

Nominees and Required Vote

Our bylaws provide that our business will be managed by or under the direction of a board of directors of not less than five ornor more than 12twelve directors. Within this range, the exact number of directors is fixed from time to time by the board of directors. The board currently consists of teneleven members. Each director will be elected at the annual meeting for a term that expires at the next regular shareholders' meeting and will hold office for the term for which he or she was elected orand until a successor is elected and qualified.

Each of the nominees named below is a current director of Fastenal and has indicated a willingness to be named in this proxy statement and to serve as a director for the ensuing year. Each of the nominees has been previously elected by our shareholders.shareholders, with the exception of Irene A. Quarshie, who was appointed as director by our board of directors effective June 9, 2023. Ms. Quarshie was recommended for consideration to join the board by a third party search firm. Proxies solicited by the board of directors will, unless otherwise directed, be voted to elect the teneleven nominees named below to constitute the entire board. Notwithstanding the foregoing, in case any such nominee is not a candidate at the annual meeting of shareholders for any reason, the proxies named in the enclosed proxy card may vote for a substitute nominee in their discretion.

The following table sets forth certain information as to each director standing for election at the annual meeting.

| Committee Memberships | ||||||||||||||||||||||||||

| Name | Age | Director Since | Principal Occupation | Board | Independent | Audit | Comp- ensation (1) | Nominating and Corporate Governance (2) | ||||||||||||||||||

| Scott A. Satterlee | 55 | 2009 | Retired President of North America Surface Transportation Division, C.H. Robinson Worldwide, Inc. | Chair | X | |||||||||||||||||||||

| Michael J. Ancius | 59 | 2009 | Vice President and Chief Financial Officer, A.L.M. Holding Company | X | X | Chair | X | |||||||||||||||||||

| Stephen L. Eastman | 59 | 2015 | President of the Aftermarket, Parts, Garments, and Accessories Division, Polaris Inc. | X | X | X | Chair | |||||||||||||||||||

| Daniel L. Florness | 60 | 2016 | President and Chief Executive Officer of Fastenal Company | X | ||||||||||||||||||||||

| Rita J. Heise | 67 | 2012 | Self-Employed Business Consultant, Retired Corporate Vice President and Chief Information Officer, Cargill, Incorporated | X | X | Chair | X | |||||||||||||||||||

| Hsenghung Sam Hsu | 54 | 2020 | Executive Vice President of Strategic Planning, Ecolab Inc. | X | X | X | X | |||||||||||||||||||

| Daniel L. Johnson | 60 | 2016 | Chief Executive Officer, M.A. Mortenson Company | X | X | X | X | |||||||||||||||||||

| Nicholas J. Lundquist | 66 | 2019 | Retired Senior Executive Vice President - Operations of Fastenal Company | X | ||||||||||||||||||||||

| Sarah N. Nielsen | 50 | 2021 | Chief Financial Officer of First Citizens Bank | X | X | X | X | |||||||||||||||||||

| Irene A. Quarshie | 47 | 2023 | Senior Vice President of Global Supply Chain and Logistics for Target Corporation | X | X | X | X | |||||||||||||||||||

| Reyne K. Wisecup | 61 | 2000 | Retired Senior Executive Vice President - Human Resources of Fastenal Company | X | ||||||||||||||||||||||

| Number of 2023 meetings | 4 | 4 | 6 | 5 | 4 | |||||||||||||||||||||

(1) On February 7, 2024, the composition of our compensation committee changed. Throughout 2023 and nominee foruntil February 7, 2024, the officemembers were Ms. Heise (Chair), Mr. Ancius, Mr. Eastman, and Mr. Johnson.

(2) On February 7, 2024, the composition of director.our nominating and corporate governance committee changed. Throughout 2023 and until February 7, 2024, the members were Mr. Eastman (Chair), Ms. Heise, Mr. Hsu, and Mr. Johnson.

-5-

| Name | Age | Director Since | Position | ||

| Willard D. Oberton | 59 | 1999 | Chairman of the Board and Director | ||

| Michael J. Ancius | 53 | 2009 | Director | ||

| Michael J. Dolan | 69 | 2000 | Director | ||

| Stephen L. Eastman | 53 | 2015 | Director | ||

| Daniel L. Florness | 54 | 2016 | President, Chief Executive Officer, and Director | ||

| Rita J. Heise | 61 | 2012 | Director | ||

| Darren R. Jackson | 53 | 2012 | Director | ||

| Daniel L. Johnson | 54 | 2016 | Director | ||

| Scott A. Satterlee | 49 | 2009 | Director | ||

| Reyne K. Wisecup | 55 | 2000 | Senior Executive Vice President – Human Resources and Director | ||

Director Qualifications

Fastenal's board of directors is comprised of a diverse group of individuals of varying backgrounds and experiences. Our directors who are current or former members of management directors bring important internal insights and perspective developed during their years of experience in operations and administration at the company. They provide direct-line feedback for the people-centered culture that has played a major role in the company's success. Our independent directors contribute a variety of expertise derived from their backgrounds in the areas of entrepreneurial leadership, strategic planning, multi-location sales and marketing, manufacturing, distribution, logistics, supply chain, commercial construction, international market development, information technology, publicly-held company reporting, professional administration, investor relations, risk management, and accounting.

The board believes each of the nominees possesses the experience, skills, and attributes to serve on the company's board of directors, and collectively contribute to its ongoing success.

Mr. Willard D. Oberton hasScott A. Satterlee serves as chair of the board. He retired in January 2016 as president of the North America Surface Transportation Division of C.H. Robinson Worldwide, Inc., a position he held since December 2014. He served as chairmana senior vice president of transportation of C.H. Robinson from December 2007 through December 2014, and as a vice president of transportation of C.H. Robinson from early 2002 through December 2007. C.H. Robinson is a publicly-held global provider of transportation and logistics services headquartered in Eden Prairie, Minnesota. As an executive officer of C.H. Robinson, Mr. Satterlee was responsible for a portion of its worldwide operations with duties that included oversight of a decentralized network of offices, each with local and global account relationships. Additionally, Mr. Satterlee helped develop and oversee implementation of network compensation plans for C.H. Robinson, and was accountable for expanding operations into portions of South America, Europe, and Asia. Mr. Satterlee has also served on various non-profit boards in the Rocky Mountain region. He brings multi-location operational, compensation, and international business development experience to the board, all consistent with our company's strategic focus.

Mr. Satterlee attended 100% of the general meetings of the board since April 2014. He also served as the company's chief executive officer from December 2002 through December 2014, when he retired from that position, and again on an interim basis from July 2015 through December 2015. He began his business career with Fastenal in January 1980, and was promoted to branch manager, then district manager, and later to general operations manager. He served as our vice president from March 1997 through June 2000, as our executive vice president from June 2000 through July 2001, as our chief operating officer from March 1997 through December 2002, and as our president from July 2001 through July 2012 and again on an interim basis from July 2015 through December 2015. Mr. Oberton's professional career grew from within Fastenal as he successfully worked, managed, and provided leadership to most of the departments and disciplines integral to the company's growth and financial success. Mr. Oberton's varied experience with the company, including his long tenure as chief executive officer, gives the board unique insight into the company's 'success drivers' and provides continuity to Mr. Florness in the development and execution of the company's strategy. In addition, Mr. Oberton serves on the board of directors of publicly-held Donaldson Company, which gives him useful insight into another organization's corporate governance, compensation planning, and strategic development. Also, he serves on the board of WinCraft, Inc., a privately-held company involved in manufacturing and2023.

Mr. Michael J. Ancius serves has served as the vice president and chief financial officer of A.L.M. Holding Company since January 2018 and he began working for the company in June 2017. A.L.M. Holding Company is a privately-held construction and energy company headquartered in Onalaska, Wisconsin. From 1997 to June 2017, Mr. Ancius was the director of strategic planning, financing, and taxation of Kwik Trip, Inc., a privately-held multi-location convenience store chain headquartered in La Crosse, Wisconsin.chain. Prior to 1997, Mr. Ancius was a senior manager with the certified public accounting firm of RSM US LLP for ten years, where he specialized in taxation. His background in strategic planning, board operations, capital markets, capital structures and valuations, insurance risk management, development of compensation strategies, taxation, and financial and accounting matters contributes a unique set of skills to the board. Additionally, his experience with strategic planningtaxation and developmentfinancial accounting matters, as well as completing a CERT Certificate in Cybersecurity Oversight from the National Association of compensation strategiesCorporate Directors, brings beneficial insight to our compensation committee.

Mr. Ancius attended 100% of the general meetings of the board in 2023, as well as 100% of trustees of St. Mary's University, Winona, Minnesota.

Mr. Stephen L. Eastman has served as president of the aftermarket, parts, garments, and accessories (PG&A) division of Polaris Industries Inc., headquartered in Medina, Minnesota, a manufacturer and marketer of recreational vehicles with $5.4$8.9 billion in annual revenues, since August 2015. In his capacity as president, he is responsible for leading the global business, strategic direction, product and brand development, supply chain operations, and multi-channel sales marketing, and e-commerce,marketing, of the aftermarket, parts, garments, and accessories division. From February 2012 to August 2015, he served as vice president of that same division. He has also led the acquisition and integration of several after market businesses including the 2016 acquisition of Transamerican Auto Parts, a vertically integrated manufacturer, distributor, retailer, and installer of off-road Jeep and truck accessories.aftermarket brands. From October 2011 to February 2012, Mr. Eastman worked as an independent business consultant. Prior to October 2011, Mr. Eastman held various managerial positions during a tenure of almost 30 years with Target Corporation, a multi-location and online retailer of consumer products, including president of Target.com from 2008 to October 2011. His background in executive and managerial leadership in multi-location consumer products companies, supply chain strategy, inventory management, e-commerce,eCommerce, and mergers and acquisitions integration provides valuable insight and guidance in these areas to the board. Mr. Eastman also serves on the non-profit board of directors forof the Boys and Girls Club of the Twin Cities. Additionally, Mr. Eastman's diverse business background provides the experience to chair the company's nominating and corporate governance committee.

Mr. Eastman has been a directorattended 100% of Fastenal since 2015 and is a memberthe general meetings of our auditthe board in 2023, as well as 100% of both the compensation and nominating committees.and corporate governance committee meetings in 2023.

-6-

Mr. Daniel L. Florness has served as the company's president and chief executive officer since January 2016. He began his career at Fastenal in 1996 and served as the company's chief financial officer from June 1996 to December 2002, and as an executive vice president and the chief financial officer of the company from December 2002 to December 2015. During his time as chief financial officer, Mr. Florness' experience with the company expanded beyond finance, including leadership of product development and procurement, a portion of our manufacturing division, and, in later years, our national accounts business. In his role as president and chief executive officer, Mr. Florness provides the board with critical input on the development and implementation of high level strategies for the company and on the overall operations and resources of the company. In addition, his long prior tenure as chief financial officer makes Mr. Florness uniquely situated to provide the board with in-depth insight into the company's financial planning, internal controls, and regulatory compliance. Mr. Florness also serves on the board of directors of PlastiComp, Inc.,H.B. Fuller, a privately-heldpublicly-held company specializing in the provision of long fiber thermoplastic compositesglobal adhesives market and technologies, andis on the board of trustees of Bellin Gundersen Health System, Inc., an integrated health care system primarily located in Wisconsin, as well as Upper Michigan, northeastern Iowa, and southeastern Minnesota. Additionally, he has served on the boards of various community organizations.

Mr. Florness has been a directorattended 100% of Fastenal since January 2016.the general meetings of the board in 2023.

Ms. Rita J. Heise has worked as a business consultant since January 2012. From 2002 through her retirement retired in December 2011 she served as a corporate vice president and chief information officer of Cargill, Incorporated, an international producer and marketer of food, agricultural, financial and industrial products and services, and one of the largest privately-owned companies in the world.world headquartered in Wayzata, Minnesota. In her capacity as the chief information officer, she was responsible for Cargill's information technology worldwide. While at Cargill, she also served as a platform leader providing executive leadership for the agriculture horizon, animal nutrition, and salt/de-icing businesses and was a member of the business transformation and process improvement leadership teams. Prior to joining Cargill, Ms. Heise was the chief information officer for the aerospace business of Honeywell International Inc. and for Honeywell's Europe, Middle East, and Africa operations. During her 25 years at Honeywell, she worked on business integrations, process improvement teams, and mergers and acquisitions; led various information technology assignments; and held various positions in supply chain, operations, customer service, and distribution. Ms. Heise has participated in information technology industry committees and currently serves as chair ofpreviously served on the board of Blue Cross Blue Shield of Minnesota (BCBSMN), a non-profit health services company. Ms. Heisecompany, where she also servesserved as chair of the board. She previously served on the board of directors ofAdventium Labs, a privately-held systems engineering and cyber security company, and Curtiss Wright Corporation, a publicly-held engineering company specializing in providing high-tech, critical-function products, systems, and services to the commercial, industrial, defense and power markets. She previously served on the board of Adventium Labs, a privately-held systems engineering and cyber-security company. Her information technology background, combined with a diverse operations background, offers the board valuable insight on ways for Fastenal to maximize the use of advancing technologies in marketing, operations, and distribution, and to effectively manage cyber-securitycyber security risks. Additionally, Ms. Heise's diverse business background provides the experience to chair the company's compensation committee.

Ms. Heise has been a directorattended 100% of Fastenal since 2012the general meetings of the board in 2023, as well as 100% of both the compensation and nominating and corporate governance committee meetings in 2023.

Mr. Hsenghung Sam Hsuis a memberexecutive vice president of our compensation committee.

Mr. Hsu attended 100% of the general meetings of the board in the LED lighting market, where he serves2023, as the chairmanwell as 100% of the audit and nominating and corporate governance committee and as a membermeetings in 2023.

-7-

Mr. Daniel L. Johnson is president and chief executive officer of M. A. Mortenson Company, a family-owned commercial, energy, and infrastructure construction company that provides construction-related contracting, development, and program management services throughout North America.America, and is headquartered in Minneapolis, Minnesota.Mortenson employs more than 4,5006,000 team members and generates in excess of $3.9$5.0 billion of annual revenues. Before assuming his current role as president and chief executive officer in January 2017, Mr. Johnson served as president of Mortenson from January 2015 to December 2016 and as chief operating officer of Mortenson from 2008 to December 2014. Prior to that, he held various leadership and managerial positions with Mortenson since joining that company in 1986. Non-residential construction customers have historically represented a meaningful portion of Fastenal's sales, and Mr. Johnson's background in executive and managerial leadership of a major construction company provides the board with valuable insight into and guidance regarding this important sector of Fastenal's business. Mr. Johnson

also serves on several non-profit and industry boards including the Greater MSP, the Crohn's and Colitis FoundationACE Mentor Program, the North Dakota State University College of America,Engineering, and the ACE Mentor Program.Construction Industry Round Table.

Mr. Johnson has been a director of Fastenal since 2016 and is a member of our audit committee.

Mr. Nicholas J. Lundquist served as the company’s senior executive vice president – operations from December 2016 through January 2020, when he retired from that position. He began his business career with Fastenal in March 1979, serving in various distribution and sales leadership roles of increasing responsibility until being promoted to executive vice president and chief operating officer in December 2002, a position he held since December 2014.until November 2007. He served as a seniorone of the company's executive vice presidents – sales from November 2007 through July 2012 and as the company's executive vice president – operations from July 2012 through December 2016. Mr. Lundquist’s professional career grew from within Fastenal as he successfully worked, managed, and provided leadership to many of transportationthe departments and disciplines integral to the company's growth and financial success. Mr. Lundquist’s varied experience with the company, including his long tenure in senior sales and operational management roles, gives the board deeper insight into the company’s people centered culture, as well as its sales channels, distribution operations, product and supplier development, and supply chain. His career path epitomizes the company's ‘promote from within’ philosophy which is a cornerstone of Fastenal's culture.

Mr. Lundquist attended 100% of the general meetings of the board in 2023.

Ms. Sarah N. Nielsen is currently the chief financial officer of First Citizens Bank, a locally-owned community bank in Mason City, Iowa, serving in this capacity since November 2017. From November 2005 to May 2017, she served as vice president and chief financial officer of Winnebago Industries, Inc., a publicly-held leading U.S. manufacturer of outdoor lifestyle experiences including motorhomes, travel trailers, fifth wheels, and boats under the Winnebago, Grand Design, Chris-Craft, and Newmar brands. During her tenure with Winnebago, she led the due diligence and financing efforts that resulted in the strategic acquisition of Grand Design RV, developed long term strategies surrounding post-retirement healthcare benefits, implemented a strategic sourcing and procurement program, and was involved with the management and oversight of certain divisions within this organization. From 1995 through 2005, she was employed with Deloitte & Touche LLP, achieving the role of senior audit manager. Her background in financial management and reporting, strategic planning, sourcing, and public company board governance provides valuable insight and guidance in these areas to the board. Ms. Nielsen currently serves as the chair-elect and executive committee member of the board of directors for the Clear Lake Area Chamber of Commerce, a non-profit organization, which she joined in 2018. She served on the audit committee of the board of directors for the Recreation Vehicle Industry Association, a national trade association, from 2014 through 2017.

Ms. Nielsen attended 100% of the general meetings of the board in 2023, as well as 100% of the audit committee meetings in 2023.

Ms. Irene A. Quarshie has served as the Senior Vice President of Global Supply Chain and Logistics for Target Corporation since March 2022. Target Corporation is a Fortune 50, multi-category retailer with locations in all 50 U.S. states and the District of Columbia, with headquarters in Minneapolis, Minnesota. Her prior positions and roles with Target consisted of serving as Vice President of Global Supply Chain and Logistics from January 2018 to February 2022, Vice President of Product Quality and Responsible Sourcing from 2014 to 2018, Director of Government Affairs from 2011 to 2014, Senior Group Manager of Corporate Risk and Responsibility from 2009 to 2011, and various managerial positions from 2005 to 2009. Prior to joining Target, Ms. Quarshie served as a consultant with the global management consulting services firm of Booz Allen Hamilton from 2001 to 2005. Her background in global supply chain issues provides valuable insight and guidance in these areas to the board. Ms. Quarshie currently serves as an audit committee member of the board of directors for the Executive Leadership Council, a non-profit organization, which she joined in 2018. Ms. Quarshie previously served as an executive committee member of the board of directors for the Guthrie Theatre, a non-profit organization, from 2019 to 2023. She previously served as an advisory board member of the board of directors for Inspectorio, a privately held company, from December 2007 through December 2014, and a vice president2015 to 2019. She previously served as the chair of transportationthe executive committee of that company from early 2002 through December 2007. C.H. Robinson is a publicly-held global provider of transportation and logistics services headquartered in Eden Prairie, Minnesota. As an executive officer of C.H. Robinson, Mr. Satterlee was responsible for a portion of its worldwide operations with duties that included oversight of a decentralized network of offices, each with local and global account relationships. Additionally, Mr. Satterlee helped develop and oversee implementation of network compensation plans for C.H. Robinson, and was accountable for expanding operations into portions of South America, Europe, and Asia. He brings multi-location operational, compensation, and international business development experience to the board all consistent with our company's strategic focus.of directors for the YWCA of Minneapolis, MN, a non-profit organization, from 2012 to 2018.

-8-

Ms. Quarshie attended 100% of our compensation committee.the general meetings of the board in 2023, as well as 100% of the audit committee meetings in 2023, that were held during her term of service on the board.

Ms. Reyne K. Wisecup serves served as the company's senior executive vice president – human resources.resources from December 2016 through February 2023, when she retired from that position. She began her career atwith Fastenal in 1988 and served in various operational and administrative areas until beingthrough 1997, when she was named director of human resources director in April 1997.resources. In April 2002, she was promoted to vice president of employee development, a position she held untiland in November 2007, when she was named the company's executive vice president – human resources. Inresources serving in that position through December 2016, Ms. Wisecup was promoted to senior executive vice president - human resources.2016. In her capacity as senior executive vice president – human resources, Ms. Wisecup managesmanaged the company's human resources department which includesincluded human relations, payroll, benefits, diversity and compliance, general insurance, legal, and the Fastenal School of Business. Because we credit much of our success to our 'people centered' decentralized structure, relying upon the entrepreneurial motivation and creative energy of our employees, Ms. Wisecup provides a very helpful direct link betweeninsights and knowledge of the employeescompany's policies and the boardhuman resources departments based upon her tenured background, which aids the board in shaping employee relations. Her career path also epitomizes the 'promote from within' philosophy which is a cornerstone of Fastenal's culture.philosophy.

Ms. Wisecup has been a directorattended 100% of Fastenal since 2000.the general meetings of the board in 2023.

None of the above nominees is related to any other nominee or to any of our executive officers.

THE BOARD OF DIRECTORS RECOMMENDS VOTING FOR

THE ELECTION OF EACH OF THE ABOVE NOMINEES

* * * * * * * * * *

CORPORATE GOVERNANCE AND DIRECTOR COMPENSATION

Director Independence and Other Board Matters

Our board of directors has determined that none of Mr. Ancius,Satterlee, Mr. Dolan,Ancius, Mr. Eastman, Ms. Heise, Mr. Jackson,Hsu, Mr. Johnson, Ms. Nielsen, or Mr. SatterleeMs. Quarshie has any relationships that would interfere with the exercise by such person of independent judgment in the carrying out of his or her responsibilities as a director and that each such individual is an independent director under the listing standards of the Nasdaq Stock Market (herein referred to as 'independent directors'). The independent directors constitute a majority of our board of directors and a majority of the nominees for the office of director. In making the board's independence determination, the members of the board were aware of and considered various transactions between Fastenal on the one hand, and companies in or with respect to which certain of our directors have equity interests or serve as directors, officers, or employees, on the other hand.employees. Those transactions consisted of the purchase of products by such companies from Fastenal in the ordinary course of business and on terms available to comparable unrelated customers in similar circumstances, and the purchase by Fastenal of products or services from such companies in the ordinary course of business on terms negotiated on an arm's-length basis. None of our directors were in any way directly involved with any of these transactions.

The executive assistant to our chief executive officer periodically reviews all such e-mails and forwards all communications from our shareholders, and all communications from other interested parties requiring board attention, to the chairman of the board.

| Total Number of Directors | 11 | |||||||||||||||||||||||||

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | ||||||||||||||||||||||

| Directors | 4 | 7 | — | — | ||||||||||||||||||||||

| Part II: Demographic Background | ||||||||||||||||||||||||||

| African American or Black (not of Hispanic or Latinx origin) | 1 | — | — | — | ||||||||||||||||||||||

| Alaskan Native or Native American | — | — | — | — | ||||||||||||||||||||||

| Asian | — | 1 | — | — | ||||||||||||||||||||||

| Hispanic or Latinx | — | — | — | — | ||||||||||||||||||||||

| Middle Eastern or North African | — | — | — | — | ||||||||||||||||||||||

| Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||||||||||||||

| White (not of Hispanic or Latinx origin) | 3 | 6 | — | — | ||||||||||||||||||||||

| Two or More Races or Ethnicities | — | — | — | — | ||||||||||||||||||||||

| LGBTQ+ | — | |||||||||||||||||||||||||

| Did Not Disclose Demographic Background | — | |||||||||||||||||||||||||

-9-

Board Diversity Matrix (as of February 1, 2023)

The following chart summarizes certain self-identified personal characteristics of our directors, in accordance with Nasdaq Listing Rule 5605(f). Each term used in the table has the meaning given to it in the rule and related instructions.

| Total Number of Directors | 10 | |||||||||||||||||||||||||

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | ||||||||||||||||||||||

| Directors | 3 | 7 | — | — | ||||||||||||||||||||||

| Part II: Demographic Background | ||||||||||||||||||||||||||

| African American or Black (not of Hispanic or Latinx origin) | — | — | — | — | ||||||||||||||||||||||

| Alaskan Native or Native American | — | — | — | — | ||||||||||||||||||||||

| Asian | — | 1 | — | — | ||||||||||||||||||||||

| Hispanic or Latinx | — | — | — | — | ||||||||||||||||||||||

| Middle Eastern or North African | — | — | — | — | ||||||||||||||||||||||

| Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||||||||||||||

| White (not of Hispanic or Latinx origin) | 3 | 6 | — | — | ||||||||||||||||||||||

| Two or More Races or Ethnicities | — | — | — | — | ||||||||||||||||||||||

| LGBTQ+ | — | |||||||||||||||||||||||||

| Did Not Disclose Demographic Background | — | |||||||||||||||||||||||||

Board Leadership Structure and Committee Membership

Our corporate governance guidelines provide that the board shall determine the leadership structure of the board from time to time and that the board shall choose its chair based upon the board's view of what is in the best interest of the company at any given point in time, based on the recommendation of the nominating and corporate governance committee.

Mr. Satterlee has been the chair of the board of the company since April 2021. He has served as a director of the company for more than a decade and has high level executive experience gained as a former executive at C.H. Robinson.

As chair, Mr. Satterlee is the primary liaison between senior management and the independent directors and provides strategic input and leadership to our executive officers. With input from the other board members, committee chairs, and management, he develops the agenda for board meetings, sets board meeting schedules, and presides over meetings of the board. As the company's chair and board member for fifteen years, Mr. Satterlee combines a detailed and in-depth knowledge of the company's day-to-day operations with an ability to identify strategic priorities essential to the future success of the company and effectively execute the company's strategic plans.

Mr. Satterlee leads the executive sessions of the independent directors focused on a spontaneous agenda developed by directors to address the most critical issues. His role is to help assure that timethose sessions remain effective forums for promoting open and candid discussion among the independent directors regarding issues of importance to the company, including evaluating the performance and effectiveness of members of management.

While the roles of chair and chief executive officer are currently separated, the board does not have a policy on whether or not the role of the chair and chief executive officer should be separate or combined and, if it is to be separate, whether the chair should be selected from the non-employee directors or be an executive officer. The board believes that the current separation between the role of chair and chief executive officer allows Mr. Florness to focus on the company's operations, while ensuring appropriate independent board leadership over governance matters. Our corporate governance guidelines provide that in the event that the chair of the board is not an independent director, the board should elect a 'lead independent director,' who will have the responsibility to schedule and prepare agendas for meetings of the non-employee directors. The lead independent director will communicate with the chief executive officer, disseminate information to the rest of the board in a timely manner and raise issues with management on behalf of the non-employee directors when appropriate.

During 2023, we had three standing board committees, consisting of an audit committee, a compensation committee, and a nominating and corporate governance committee. The members of these committees during 2023, and the number of meetings held by the full board, by the independent members of the board, and by each committee during 2023, are detailed in the table under 'Nominees and Required Vote' above. Each incumbent director attended our 2017 annual meeting.all meetings in 2023 of the board and the various committees on which he or she served that were held during his or her term of service on the board.

-10-

Board Oversight of Risk

The board of directors recognizes that, although risk management is a primary responsibility of the company's management, the board plays a critical role in oversight of risk. The board, in order to more specifically carry out this responsibility, has assigned the audit committee the primary duty to periodically review the company's policies and practices with respect to risk assessment and risk management, including discussing with management the company's major risk exposures and the steps that have been taken to monitor and control those exposures. Those risks include company risks, such as cyber security incidents, and industry and general economic risks, such as risks related to the impact of trade policies on our supply chain, all as further identified in our annual report. The compensation committee has been assigned the duty to assess the impact of the company's compensation programs on risk and recommend to the board of directors the adoption of any policies deemed necessary or advisable in order to mitigate compensation- and human capital management-related risks, including administration of our compensation related risks.and recovery policy as further described below. Information on the compensation committee's involvement in risk assessment and management as they relateit relates to compensation programs is provided below under 'Executive Compensation-Compensation Discussion and Analysis.' The nominating and corporate governance committee has been assigned the duty of overseeing our insider trading policy. Each committee reports to the board ensuring the board's full involvement in carrying out its responsibility for risk management.management and to ensure that risks are appropriately identified, measured, monitored, and addressed.

The board's oversight role in this area has not affected its leadership structure, largely because of the level of direct communication between various members of senior management and the board and its committees. Our corporate governance guidelines include the provisions described above relating to the board's oversight of risk management.

Environmental, Social, and Governance Matters

Fastenal has always been committed to understanding and exceeding the expectations of our employees, customers, suppliers, and shareholders. We believe we have also had significant and favorable financial and social impacts over time on the communities in which we operate. As stakeholder expectations change and evolve, including around environmental, social, and governance (ESG) matters, we are committed to changing and evolving with them. We have a strong foundation upon which to do so, including investing in infrastructure and innovation, trusting and empowering our employees, supporting local communities in which our employees work and live, embracing a frugal approach to our own resource use, and providing products and services to our customers designed specifically to reduce resource consumption throughout their supply chains.

Governance

Fastenal's board of directors is composed of a diverse group of individuals with varying backgrounds and experiences. This group is responsible for the oversight of enterprise risk, including ESG matters, and receives leadership and guidance on these topics from the committees of the board. Eight of our 11 directors are independent, including the chair of the board, which helps to broaden our perspective and deepen our understanding of ESG issues. Among the board's priorities are corporate responsibility, human capital management, and sustainability. The topic of ESG, including climate-related issues, is on the meeting agenda a minimum of twice per year.

Board Leadership Structurecomposition and Committee Membershipgovernance highlights:

•Our board chair is independent;

•Eight of our 11 directors are independent;

•Five of our 11 directors are diverse, including one who identifies as Asian, one who identifies as African American or Black, and four who identify as female;

•The board has beenthree committees: audit, compensation, and nominating and corporate governance. The charters of each of these committees can be viewed on Fastenal's investor website;

•All committees of our board are composed exclusively of independent directors;

•Director participation in board and committee meetings was 100% for each incumbent director in 2023;

•We have a 'Rooney Rule' provision, as discussed in the chairman'Director Nomination Process' below, to assure stakeholders of our commitment to including diverse candidates when considering candidates for our board of directors;

•Our company has stock ownership guidelines (detailed later in this document) requiring each non-employee director and each officer subject to Section 16 reporting requirements to achieve a specific equity ownership level;

•A full slate of director nominees is submitted to shareholders annually and elected using a majority voting standard;

•We have one class of shares; and

-11-

•Our corporate governance guidelines provide that the maximum number of employees or former employees serving on the board will not exceed thirty percent of the total number of directors on the board, which limitation may be waived by the board. Employee directors that terminate their service as an employee of the company may continue to serve as a director for up to five years after termination as an employee of the company.

Fastenal's board of directors serves as a prudent fiduciary for shareholders and oversees management of our business and resources. On matters of enterprise risk, including financial, operational, competitive, compliance, cyber security, reputational, and ESG matters, the full board has oversight responsibility and receives leadership and guidance on these topics from the audit, compensation, and nominating and corporate governance committees. This includes steps to monitor, manage, and mitigate such risks. Our standing committees support the board by addressing specific matters involving enterprise risk that relate to their respective areas of oversight.

The full board has assigned the nominating and corporate governance committee the primary duty to oversee corporate governance matters subject to board oversight, and sets high standards for our employees, officers, and directors. Among its priorities are corporate responsibility, human capital management, and sustainability. We have a strong commitment to being an ethical and responsible company acting with integrity and respect for each other, our customers and suppliers, our communities, and the environment.

Environmental

Fastenal's value proposition is to reduce the total consumption of resources in our customers' supply chain. We believe our business model directly contributes to, among other things, improved environmental efficiency and resiliency in global supply chains. To engage with Fastenal is to utilize Sustainable Solutions including environmental solutions featuring products, services, and systems to reduce consumption and waste; social solutions to improve workplace safety, supply chain diversity, and sourcing ethics; as well as governance solutions leveraging systems and reporting to improve supply chain transparency and regulatory compliance.

We have taken, and plan to continue to take, steps to reduce our own environmental footprint. We continue to work towards developing a plan to reach net zero emissions by 2050. In support of this objective, below are a few highlights:

•In late 2022, we completed a materiality assessment to define and prioritize key ESG issues impacting us and our stakeholders. This was used to further enhance our goal-setting, initiatives, and disclosure. We continued to document and assess scope 1 and scope 2 emissions, which was again documented in our annual CDP (formerly the Carbon Disclosure Project) filing.

•During 2023, we prioritized defining our ESG vision, pillars, and strategic objectives based on the topics we identified as most significant. We also conducted a scope 3 materiality assessment with a Big 4 accounting firm to gain insight into our scope 3 emissions in an effort to measure a more complete carbon inventory. We plan to apply the output of this work to help us develop objectives to reduce our environmental impact.

•We developed an internal environmental sustainability training that was launched in 2022, with over 9,000 training sessions completed in 2023. This training will help position our employees across the organization to learn and understand how they can be better environmental stewards for our business and the communities they serve.

•In 2023, we achieved third-party re-certification for three ISO certifications relative to ESG: ISO/IEC 27001 Information Security Management Systems, ISO 14001 Environmental Management Systems, and ISO 45001 Occupational Health and Safety Management Systems.

•In 2023, we improved our Business Sustainability score from EcoVadis, an organization on which many of our customers rely, and from which we are now designated as having a silver medal.

•We were awarded the 2023 Sustainability Award from the Business Intelligence Group and were also recognized on Newsweek's list of America's Greenest Companies 2024.

•We continue to practice environmental stewardship through responsible use of materials and consumption of energy through the Energy Star Portfolio Manager Partnership. This partnership helps our facilities monitor and reduce energy, fuel, and materials through a comprehensive strategic management approach.

•Our focus continues to be finding innovative ways to reduce, reuse, and recycle materials such as pallets, plastics, and metal products, as well as cardboard throughout our largest facilities. In 2023, we entered into a scrap supply agreement with Trex Company, Inc. allowing us to ship our used polyethylene film from our distribution centers, branches, and Onsites directly to Trex to be used in the manufacturing of their composite decking products.

-12-

•We are operating in Building Research Establishment Environmental Assessment Method (BREEAM)-certified facilities in the Netherlands and Czech Republic and have two buildings equipped with solar power technology. In addition, four of our locations were certified as Energy Star buildings in 2023: our Salt Lake City, Utah distribution center outperformed 87% of similar buildings nationwide; our Seattle, Washington distribution center outperformed 86% of similar buildings nationwide; our Jackson, Mississippi distribution center outperformed 75% of similar buildings nationwide; and our Winona, Minnesota home office outperformed 77% of similar buildings nationwide.

•To improve the efficiency of our fleet we continued to participate in the EPA's SmartWay program in 2023, which helps companies advance supply chain sustainability by measuring, benchmarking, and improving freight transportation efficiency. We also continued to utilize and pilot fully electric yard tractors, box trucks, and Ford E-Transits in 2023 to explore the capabilities of electric technology in our traditional vehicle fleet.

•We joined the Sustainable Packaging Coalition, which establishes a collaborative setting to advance and strengthen the case for more sustainable packaging.

Social

We believe in the unique humanness of people, and that no one group has a monopoly on talent or desire. We believe everyone has the ability to learn, change, and contribute to the success of our organization and, by extension, our society. We believe our greatest social impact begins with the 23,000-plus members of the Blue Team. We seek people that embody our cultural values of Ambition, Integrity, Innovation, and Teamwork, ask them to join, and work to give them a reason to stay. We provide training so people can improve their skills and increase their value. We trust people to take risks and make independent decisions in an entrepreneurial environment to build confidence. We most greatly value our own talent, and reward success by passionately promoting from within. Through these beliefs, we empower our human capital.

Achieving these goals includes a commitment to developing a diverse workforce and inclusive relationships in all of our endeavors. This forms the foundation to compete within the global business environment and provide our employees with expanded and enhanced opportunities throughout the world. To further this, our processes for hiring, promoting, and compensating are by design simple, visible, objective and regularly reviewed for effectiveness. This has produced considerable growth in recent years in the diversity of our workforce, statistics for which can be found in letters posted annually by our CEO and Executive Vice President of Human Resources to the Sustainability page on our website.

Our impact on the communities in which we operate derives from being a 'local' supply chain partner, where our customers, our operations, and our employees are part of the fabric. The greatest contribution we believe we can make is to serve our customers and create opportunities for our employees within these communities. Our employees are subject to our company Standards of Conduct, and we expect them to hold themselves to a high ethical standard. We challenge our employees to develop themselves, and just as critically, develop their teams, and promote talented individuals from within. We also ask them to operate with a frugal mindset of 'if I don't waste something today, we will have more resources to solve a problem tomorrow'. We believe these principles of trust, empowerment, and professional development foster a civic-mindedness that benefits the communities in which our people live. This manifests through community engagement programs, such as our estimated 2024 budget of $3.6 million that helps support local communities and the administration of the BK5K Youth charitable runs, a National Blue Team Blood Drive program in collaboration with the American Red Cross and other blood supply companies, and our employee athletic uniform program Blue Team Sports, as well as in the myriad donations of time and resources committed privately by our employees.

Our employee-centric culture is more than just a process. It is how we support each other. The Fastenal School of Business provided approximately 874,000 training sessions in 2023 on subjects ranging from computer cyber security to safety protocols to product knowledge to sales to leadership, providing each employee the opportunity for self-improvement. We ensure a safe workplace, with the Experience Modification Rate (EMR), a widely tracked workplace health and safety measure. Our EMR benchmark is 51% better than that of similar companies in our industry, indicating below-average workplace health and safety risks. We support best practices outside of our company with our Supplier Diversity Program, a program designed to facilitate purchases with small and/or diverse businesses by creating close, long-term relationships that strengthen our supply chain, and with a Supply Chain Compliance team that engages directly with global suppliers to ensure ethical business and labor practices.

Reporting

We have invested time and resources in developing an ESG reporting structure that informs investors and provides value to the company. We have chosen to align with several standards including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-related Financial Disclosures (TCFD), and have identified several United Nations Sustainable Development Goals (SDGs) that we feel we can impact. Each year we endeavor to favorably impact our scores and corporate ratings from Institutional Shareholder Services (ISS), EcoVadis, and CDP, and in 2023 we achieved this with ISS and EcoVadis. During 2023, we published our inaugural 2022 ESG report in January and our 2023 ESG report in July. We look forward to publishing annual ESG reports in the future.

-13-

Other Board and Corporate Governance Matters

Communications with the Board

All interested parties, including our shareholders, may contact our board of directors or a particular director by e-mail addressed to bod@fastenal.com, or writing to the board or a particular director in care of the executive assistant to the board at the mailing address of the company as set forth on the company's website. Registered or beneficial owners of our common stock should identify themselves in their e-mails as shareholders of the company. The executive assistant to our board of directors periodically reviews such e-mails, consults with the chair of the board, and then refers any appropriate communication to the applicable board member. The executive assistant will not forward communications received which are unrelated to the duties and responsibilities of our board of directors. The director to whom a communication is referred will determine, in consultation with company counsel if necessary, whether a copy or summary of the communication will be provided to the other directors. In consultation with company counsel if necessary, the board will respond to communications if and as appropriate.

Board Attendance at Annual Meeting

While we have no formal policy regarding attendance by directors at our annual meeting, our directors are expected to attend this meeting. Each individual serving as director of the company at that time attended our 2023 annual meeting.

CEO Succession Matters

Our compensation committee reviews and discusses with our board of directors succession plans for the chief executive officer and our other executive officers. The company has historically utilized a philosophy of 'promoting from within' our organization from a diverse selection of qualified internal candidates and will continue to promote a diverse pipeline for executive management, viewing continuity in culture and experience with our organization as paramount considerations when evaluating potential senior leadership. Any such internal search may or may not include female and racially and/or ethnically diverse candidates, depending on whether any such candidates meet the paramount considerations set forth above at the time the opportunity is available. However, should the board of directors decide to seek or engage a third-party search firm to solicit a chief executive officer from outside the company, any initial list of outside chief executive officer candidates would include female and racially and/or ethnically diverse candidates.

Anti-hedging Policies

Our directors and Section 16 officers are prohibited from hedging our stock, either directly or indirectly. Prohibited transactions include the purchase by a director or Section 16 officer of financial instruments, including without limitation, prepaid variable forward contracts, instruments for short sale or purchase or sale of call or put options, equity swaps, collars or units of exchangeable funds, that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any of our securities.

Securities Trading Policy

We have adopted a securities trading policy governing the purchase, sale, and other disposition of our securities by directors, officers, employees and certain other covered persons. The policy is designed to promote compliance with insider trading laws, rules, and regulations, as well as applicable listing standards.

Membership on Other Boards

As set forth in our corporate governance guidelines, a director must advise the chair of the board of such director's intent to serve on the board of another public company. No director may serve on more than two public company since April 2014, and served as chief executive officer from December 2002 through December 2014, when he retired from that position, and again on an interim basis from July 2015 through December 2015. Uponboards, including the election of Mr. Florness as chief executive officercompany's board, without the prior approval of the company effective January 1, 2016, the roles of chairman and chief executive officer were separated. However, separation of the two offices is not mandated by any corporate governance guidelines of the company and continued separation of the roles will depend upon specific circumstances and the experience and background of the company's leadership.

| Board | Independent | Audit | Compensation | Nominating | |||||

| Mr. Oberton | Chairman | ||||||||

| Mr. Ancius | X | X | X | Chairman | |||||

| Mr. Dolan | X | X | Chairman | Chairman | X | ||||

| Mr. Eastman | X | X | X | X | |||||

| Mr. Florness | X | ||||||||

| Ms. Heise | X | X | X | ||||||

| Mr. Jackson | X | X | X | ||||||

| Mr. Johnson | X | X | X | ||||||

| Mr. Satterlee | X | X | X | ||||||

| Ms. Wisecup | X | ||||||||

| Number of 2017 meetings | 4 | 2 | 6 | 5 | 2 | ||||

Audit Committee

Our audit committee currently consists of four directors, each of whom is an independent director. Our board of directors has determined that Mr. DolanAncius, Mr. Hsu, and Mr. JacksonMs. Nielsen are 'audit committee financial experts' under the rules of the Securities and Exchange Commission (the 'SEC').SEC.

The audit committee is responsible for overseeing our management and independent registered public accounting firm as to corporate accounting, financial reporting, internal controls, audit matters, and corporate risk management, and has the authority to:

•Select, evaluate, compensate, and replace our independent registered public accounting firm;

•Pre-approve services to be provided by our independent registered public accounting firm;

•Review and discuss with our management and independent registered public accounting firm our interim and audited annual financial statements, and recommend to our board whether the audited annual financial statements should be included in our annual report on Form 10-K;

•Discuss with our management earnings press releases and other published financial information or guidance;

-14-

•Review and discuss with management our major risk exposures, including, without limitation, corporate and information security risks, and the steps that management has taken to monitor and control such exposures;

•Monitor the activities and performance of our internal auditors and our independent registered public accounting firm;

•Monitor the independence of our independent registered public accounting firm;

•Oversee our internal compliance programs;

•Review related person transactions for potential conflict-of-interest situations; andsituations in accordance with our Related Person Transaction Approval Policy;

•Establish procedures for the receipt, retention, and treatment of complaints regarding accounting, internal controls, or auditing matters.matters; and

•Prepare a report of the audit committee as required by the rules of the SEC to be included in Fastenal's annual proxy statement.

Our audit committee operates under a written charter originally adopted by our board of directors in June 2000 and most recently amended in January 2018.2024. The audit committee reviews its charter on an annual basis to determine if any amendments are needed. A copy of the current charter is available on the Corporate Governance page of the InvestorsInvestor Relations section of our website at www.fastenal.com.

Related Person Transaction Approval Policy

In January 2007, our board of directors adopted a formal written related person transaction approval policy, which sets out our policies and procedures for the review, approval, or ratification of 'related person transactions'. For these purposes, a 'related person' is a director, nominee for director, executive officer, or holder of more than 5% of our common stock, or any immediate family member of any of the foregoing. This policy is reviewed periodically to determine if any amendments are needed.

This policy applies to any financial transaction, arrangement, or relationship or any series of similar financial transactions, arrangements, or relationships in which Fastenal is a participant and in which a related person has a direct or indirect interest, other than the following:

•Payment of compensation by Fastenal to a related person for the related person's service in the capacity or capacities that give rise to the person's status as a 'related person';

•Transactions available to all employees or all shareholders on the same terms;

•Purchases of products from Fastenal in the ordinary course of business at the same price and on the same terms as offered to our other customers, regardless of whether the transactions are required to be reported in Fastenal's filings with the SEC; and

•Transactions, which when aggregated with the amount of all other transactions between the related person and Fastenal, involve less than $120,000 in a year.

Our audit committee is required to approve any related person transaction subject to this policy before commencement of the related person transaction, provided that if the related person transaction is identified after it commences, it must be brought to the audit committee for ratification, amendment, or rescission. The chairmanchair of our audit committee has the authority to approve or take other actions in respect of any related person transaction that arises, or first becomes known, between meetings of the audit committee, provided that any action by the chairmanchair must be reported to our audit committee at its next regularly scheduled meeting.

Our audit committee will analyze the following factors, in addition to any other factors the members of the audit committee deem appropriate, in determining whether to approve a related person transaction:

•Whether the terms are fair to Fastenal;

•Whether the transaction is material to Fastenal;

•The role the related person has played in arranging the related person transaction;

•The structure of the related person transaction; and

•The interests of all related persons in the related person transaction.

Our audit committee may, in its sole discretion, approve or deny any related person transaction. Approval of a related person transaction may be conditioned upon Fastenal and the related person following certain procedures designated by the audit committee.

Transactions with Related Persons

There were no related person transactions during 20172023 required to be reported in this proxy statement.

-15-

Compensation Committee

Our compensation committee was appointed by our board of directors to discharge the board's responsibilities relating to compensation of Fastenal's executive officers and to oversee and advise the board on the adoption of policies that govern our compensation and benefit programs. Our compensation committee currently consists of fourfive directors, each of whom qualifies as an independent director.

Our compensation committee has the authority to:

•Evaluate our chief executive officer's performance, and determine and approve all elements of our chief executive officer's compensation;

•Review the evaluations of the performance of our other executive officers, and approve all elements of their compensation;

•Approve incentive plan goals for executive officers, review actual performance against goals, and approve plan awards;

•Recommend to the board stock ownership guidelines for executive officers and non-employee directors and monitor compliance with guidelines that are established;

•Review and discuss with the board succession plans for the CEOchief executive officer and other executive officers;